Highlights: Budget 2015 by

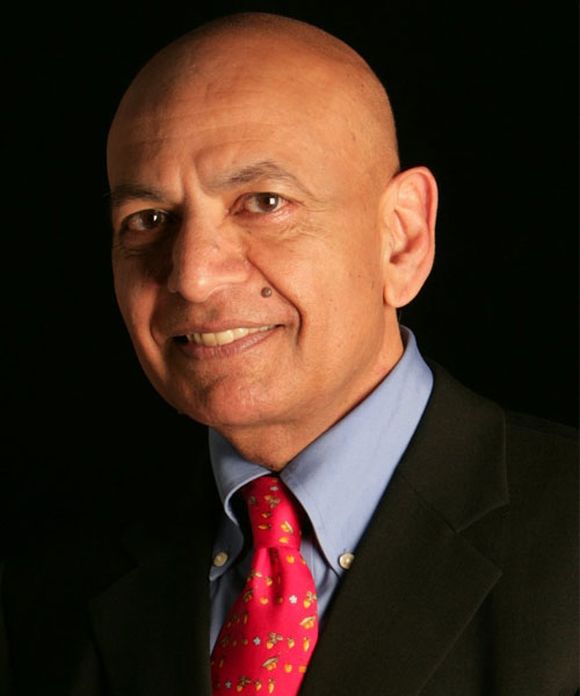

Finance Minister

Finance Minister Arun Jaitley (C) poses as he leaves his office to present the 2015/16 budget in New Delhi February 28, 2015.

REUTERS - minister of finance Arun Jaitley on weekday proclaimed

a budget geared toward high growth, voice communication the pace of cutting the

business enterprise deficit would slow as he seeks to spice up investment and

make sure that normal folks profit.

Here ar the highlights of Jaitley's take into account the

twelvemonth that begins on Gregorian calendar month one.

FISCAL DEFICIT

* business enterprise deficit seen at three.9 p.c of gross

domestic product in 2015/16

* can meet the difficult business enterprise target of four.1

p.c of gross domestic product

* stay committed to meeting medium term business enterprise

deficit target of three p.c of gross domestic product

* accounting deficit below one.3 p.c of gross domestic product

* Jaitley says have to be compelled to keep business enterprise

discipline in mind despite want for higher investment

GROWTH

* gross domestic product growth seen at between eight p.c and

eight.5 p.c y/y

* Nominal economic process seen between eleven and twelve p.c

* Aiming integer rate of growth, doable presently

INFLATION

* Expects shopper inflation to stay near five p.c by March, gap

space for a lot of financial policy easing

* financial policy framework agreement with the tally clearly

states objective of keeping inflation below vi p.c

* "One of the achievements of my government has been to

overcome inflation. This decline in my read represents a structural

shift."

REVENUES

* Revenue deficit seen at a pair of.8 p.c of gross domestic

product

* Non taxation seen at a pair of.21 trillion rupees

* Agricultural incomes ar underneath stress

* web receipts underneath market stabilisation theme calculable

at two hundred billion rupees

DISINVESTMENT

* Government targets 410 billion rupees ($6.7 billion) from

stake sales in firms in 2015/16

* Total stake sale in 2015/16 seen at 695 billion rupees

* Sets stake sale target for 2016/17 at 550 billion rupees

* Revises down stake sale target for 2014/15 to 313.5 billion

rupees

MARKET REFORMS

* Propose to merge commodities regulator with SEBI

* To bring a replacement bankruptcy code

* Jaitley says can move to amend the tally act this year, and

supply for a financial policy committee

* to line up debt management agency

* Proposes to introduce a public contract resolution of disputes

bill

* to determine associate degree autonomous bank board bureau to enhance

management of public sector banks

POLICY REFORMS

* To enact a comprehensive new law on black cash

* Propose to make a universal social insurance system for all

Indians

* To launch a national skills mission presently to boost

employability of rural youth

* to lift visa-on-arrival facility to one hundred fifty

countries from forty three

* Allocates 346.99 billion rupees for rural employment guarantee

theme

* Raises threshold for application of transfer valuation rules

to two hundred million rupees from current fifty million rupees

BORROWING

* Gross market borrowing seen at vi trillion rupees

* web market borrowing seen at four.56 trillion rupees

GENERAL ANTI-AVOIDANCE RULES (GAAR)

* Government defers rollout of anti-tax turning away rules GAAR

by 2 years

* GAAR to use prospectively from Gregorian calendar month one,

2017

* Retrospective tax provisions are avoided

TAXATION

* To get rid of wealth tax

* Replaces wealth tax with extra a pair of proportion surcharge

on super wealthy

* Proposes to chop to twenty five p.c company tax over next four

years

* company tax of thirty p.c is noncompetitive

* web gain from tax proposals seen at one hundred fifty.68

billion rupees

* Jaitley proposes modification of permanent institution norms

so the mere presence of a fund manager in Bharat wouldn't represent a permanent

institution of the offshore fund, leading to adverse tax consequences.

* Proposes to rationalise capital gains tax regime for realty

investment trusts

* Extends income tax concession on foreign debt purchases by 2

years

* Expects to implement product and services tax by Gregorian

calendar month 2016

* to cut back custom duty on twenty two things

* Basic custom duty on business vehicle doubled to twenty p.c

* Proposes to extend service charge per unit and education cess

to fourteen p.c from twelve.36 percent

* Plans to introduce revenue enhancement regime that's

internationally competitive on rates while not exemptions

* Exemptions for individual tax payers to continue

* To enact robust penalties for nonpayment in new bill

* Tax dept to clarify indirect transfer of assets and dividend

paid by foreign companies

PERSONAL INCOME TAX

* No revision of revenue enhancement brackets

* Limit of deduction of insurance premium exaggerated to twenty

five,000 rupees from fifteen,000 rupees; limit exaggerated to thirty,000 rupees

from twenty,000 rupees for the aged

* folks aged higher than eighty and not lined by insurance to be

allowed deduction of thirty,000 rupees for medical expenses

* extra deduction of twenty five,000 rupees for the disabled

* Limit on deduction for contributions to pension fund and new

pension theme exaggerated to one hundred fifty,000 rupees from one hundred,000

rupees

* extra deduction of fifty,000 rupees for contribution to new

pension theme underneath section 80CCD

* Monthly transport allowance exemption doubled to one,600

rupees

IMPORT TAX

* Import tax on iron and steel exaggerated to fifteen p.c from

ten p.c

* Import tax on metallurgic coke exaggerated to five p.c from a

pair of.5 percent

INFRASTRUCTURE

* Investment in infrastructure can go up by 700 bln rupees in

2015/16 over last year

* Plans to line up national investment infrastructure fund

* Proposes tax-exempt infrastructure bonds for comes in roads,

rail and irrigation comes

* Proposes five "ultra mega" power comes for four,000

MW every

* Second unit of Kudankulam nuclear energy station to be

commissioned

* can have to be compelled to build extra one hundred,000 metric

linear unit of road

* Ports publicly sector are inspired to corporatise underneath

firms Act

EXPENDITURE

* arrange expenditure calculable at concerning four.65 trillion

rupees

* Non-plan expenditure seen at concerning thirteen.12 trillion

rupees

* Allocates a pair of.46 trillion rupees for defence defrayal

* Allocates 331.5 billion rupees for health sector

* If revenue improves, hope to lift budgeted allocations for

rural job theme by fifty billion rupees

INVESTMENT

* Government to produce seventy nine.4 billion rupees capital

infusion to state-run banks

* Propose to try to to away with differing kinds of foreign

investment caps and replace them with composite caps

* to permit foreign investment in different assets

* Public investment required to change state investment

GOLD

* To launch gold deposit accounts and sovereign bond

* tariff stays at ten percent; disappoints jewellers

* to figure on Indian-made gold coin to chop imports

CIGARETTES

* Raises excise duty on cigarettes by twenty five p.c for

cigarettes of length not extraordinary sixty five millimetre

* Raises excise duty by fifteen p.c for cigarettes of

alternative lengths

SUBSIDIES

* Food grant seen at one.24 trillion rupees

* plant food grant seen at 729.69 billion rupees

* Fuel grant seen at three hundred billion rupees

* Major subsidies calculable at a pair of.27 trillion rupees

* we have a tendency to ar committed to grant rationalisation

supported cutting leakages

FINANCE MINISTER'S COMMENTS

* "We hereditary a sentiment of doom and gloom. The

investment community had nearly written North American country off. we've got

return an extended manner since then."

* "We have turned the economy, dramatically restoring

political economy stability and making the conditions for property

impoverishment elimination, job creation, sturdy integer economic

process."

* "While being aware of the challenges ... this offers

North American country reason to feel optimistic."

* "Domestic and international investors ar seeing North

American country with revived interest and hope."

MODI ON TWITTER

* 2015 Budget can additional light our growth engine, signalling

the dawn of a prosperous future.

* Budget is investment friendly & removes all doubts on

tax problems. It assures investors that we've got a stable, inevitable

& truthful legal system.

MARKET REACTION

* BSE index gains zero.48 percent; NSE index up zero.65 percent

* ITC slumps when budget hikes excise duty on cigarettes

($1 = 61.6489 rupees)